rhode island sports betting tax rate

Unfortunately like all major US. Facilities are required to withhold 24 of your earnings.

Will High Tax Rate For New York Sportsbooks Affect Bettors

Nevada has one of the.

. Web If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. 4 Rhode Island Sports. Web Sports betting tax revenue by State for 2020.

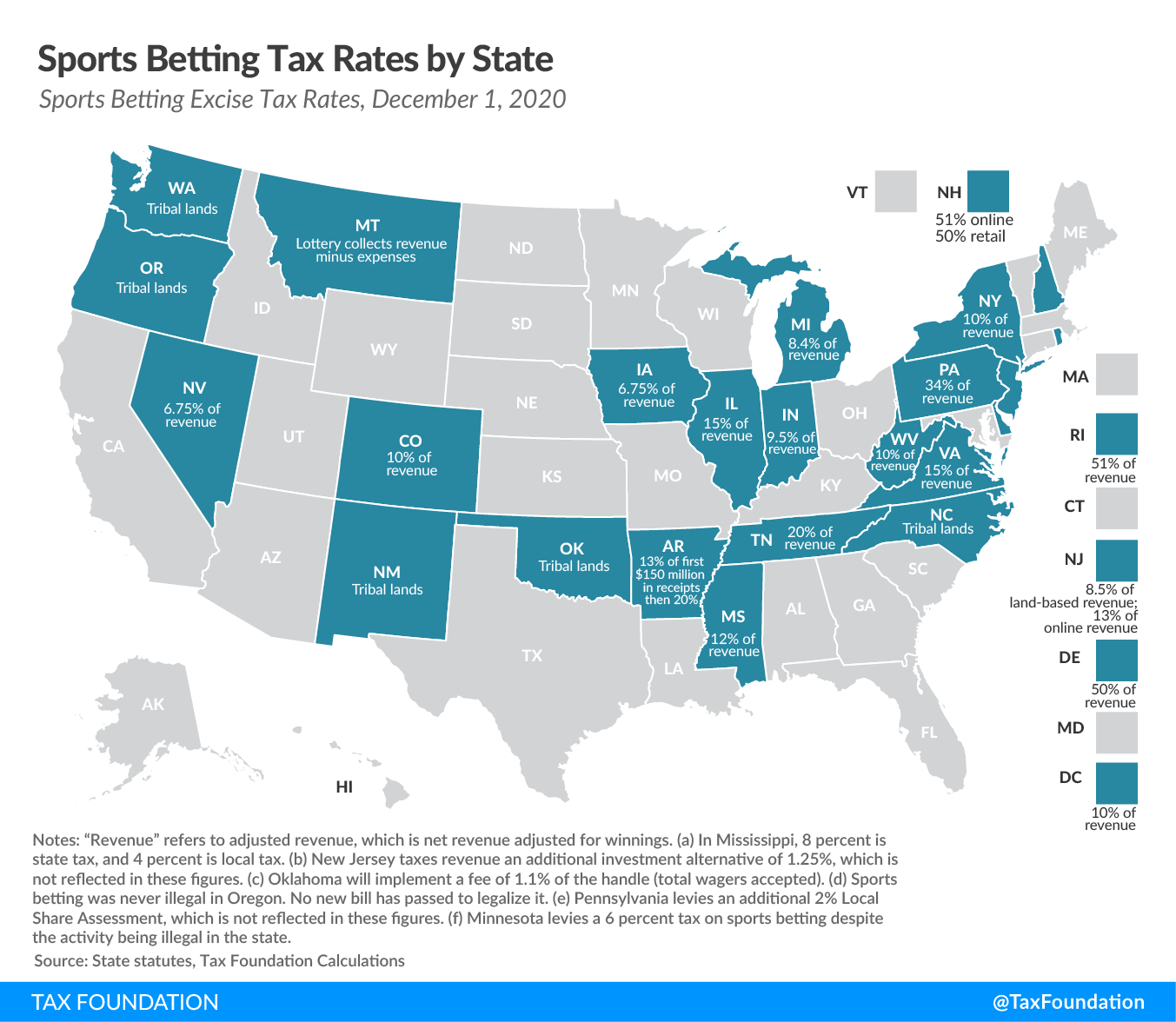

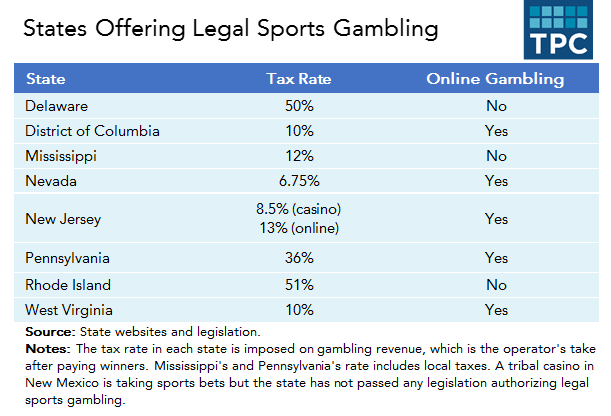

Web The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate. Tax rates are built with the goal of getting each. Pennsylvania has a massive 36 percent effective tax rate on top of a 10 million initial licensing fee.

This leads to much more attractive odds than the retail bookies. Web Rhode Island sports betting revenue is taxed at a rate of 51. Web Rhode island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting.

Rhode Island has offered legal online sports betting since March 2019. Web If a player loses 100 on a sports bet the state will keep 51 IGT will get 32 and Twin River will get 17 but those rates do not sit well with critics. The Rhode Island Lottery takes 599 of all the total winnings.

Web Caesars is proving to be one of the most aggressively expanding brands in sports betting. Web Heres a look at Nevada sports betting handle and revenue since June 2018 the month that the first sportsbooks opened in other states. Web Rhode Island Sports Betting Laws And Tax Rates Rhode Island was one of the first states in the US to offer sports betting launching in 2018 via retail outlets.

State 51 IGT 32 Casino 17 What You Can Bet On In Rhode Island. Web Rhode Island Online Sports Betting. How States Tax Sports Betting.

Web As it is run by the state the Sportsbook Rhode Island online bookie only applies a 599 tax on gambling revenues. Web Delaware and Rhode Island both have a revenue-sharing model where revenue is shared between state casinos and operators. However as of October 2020 it only features one operator state-run.

Web How States Tax Sports Betting Winnings. Web Rhode Island also became the state with the highest tax rate according to the law sports betting profits will be split between the state the states gaming operator. You should also expect to pay another 24 in.

Web Rhode Islands tax rate is an unbelievable 51 percent. We take a look at the top 5 earners and breakdown each states earnings by month. Sports betting is legal in Rhode Island and residents have the option to use the domestic.

Sportsbooks they are quick to limit you if you go on a. States have set rules on betting including rules on taxing bets in a variety of ways.

Rhode Island Sports Betting Legal Ri Sportsbook Sites

Let S Talk About Pa S Insanely High Sports Betting Tax

Rhode Island Sports Betting Hits 13m In First Month

Monthly Sports Betting Tax Revenue In Rhode Island 2022 Statista

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

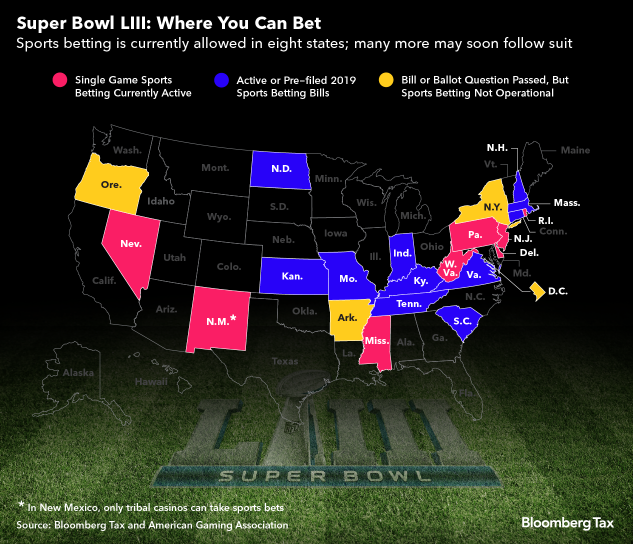

Super Bowl Gamblers Here S Where You Can Bet How You Ll Be Taxed

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Online Sports Betting In Rhode Island Potential Revenue And Growth

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

New York Sets Sports Betting Tax Revenue Record

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

New York Tops Nation In Sports Betting Tax Revenue As Promotions Taper Crain S New York Business

Super Bowl Sports Betting And State Tax Revenue Tax Foundation

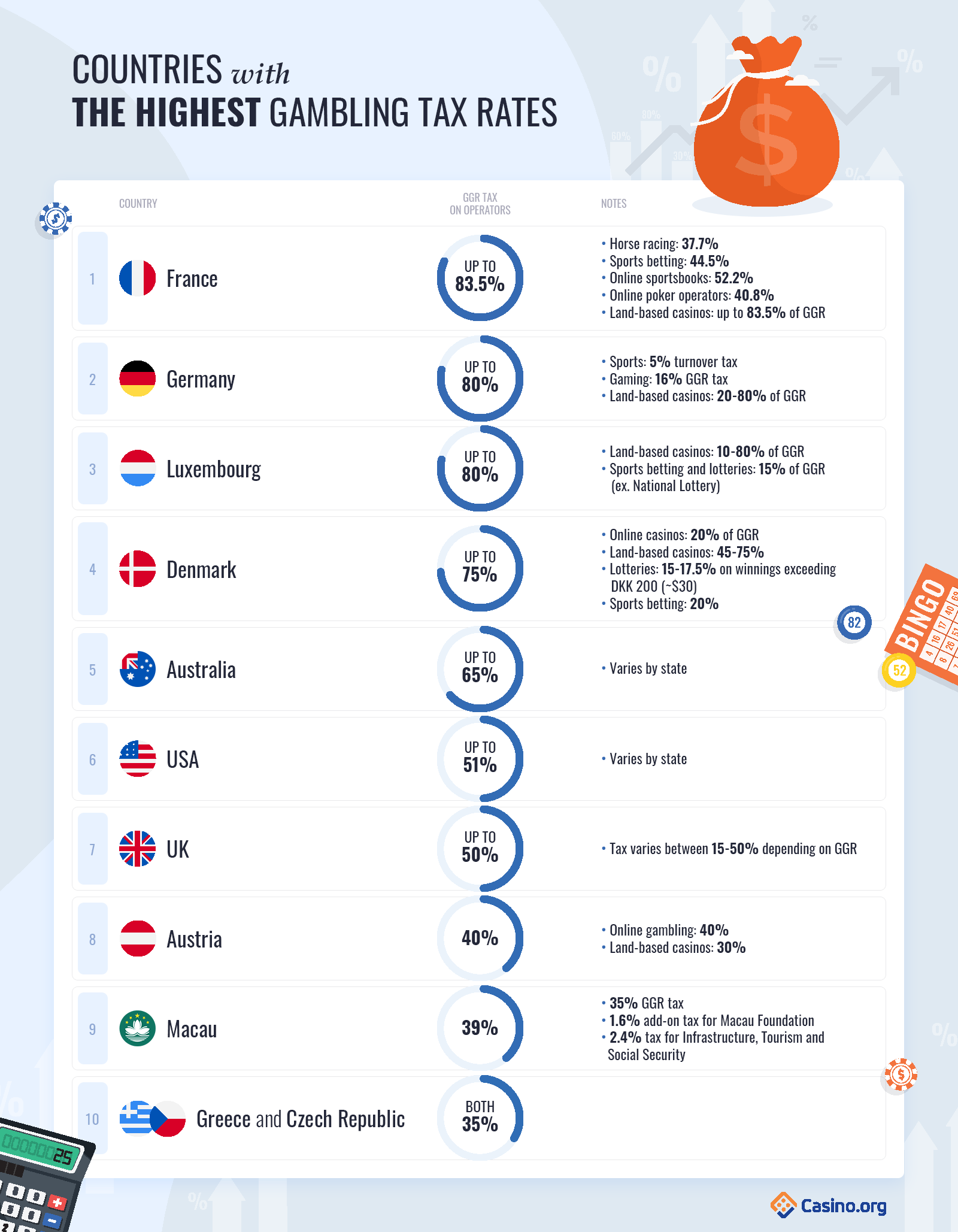

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Massachusetts Senate Passes Sports Betting Bill News Berkshireeagle Com

Tpc S Sports Gambling Tip Sheet Tax Policy Center

Tax Spend How Regulations Impact Igaming And Sports Betting Success Ggb Magazine

Sports Betting Will Be No Home Run For State Budgets Ap News